Main Menu

Main Menu |

Most Favorited Images

Most Favorited Images |

Recently Uploaded Images

Recently Uploaded Images |

Most Liked Images

Most Liked Images |

Top Reviewers

Top Reviewers |

| cockalatte |

645 |

| MoneyManMatt |

490 |

| Still Looking |

399 |

| samcruz |

398 |

| Jon Bon |

385 |

| Harley Diablo |

370 |

| honest_abe |

362 |

| DFW_Ladies_Man |

313 |

| Chung Tran |

288 |

| lupegarland |

287 |

| nicemusic |

285 |

| You&Me |

281 |

| Starscream66 |

262 |

| sharkman29 |

250 |

| George Spelvin |

244 |

|

Top Posters

Top Posters |

| DallasRain | 70387 | | biomed1 | 60320 | | Yssup Rider | 59856 | | gman44 | 52869 | | LexusLover | 51038 | | WTF | 48267 | | offshoredrilling | 47441 | | pyramider | 46370 | | bambino | 40288 | | CryptKicker | 37064 | | Mokoa | 36485 | | Chung Tran | 36100 | | Still Looking | 35944 | | The_Waco_Kid | 35180 | | Mojojo | 33117 |

|

|

08-24-2011, 08:23 AM

08-24-2011, 08:23 AM

|

#31

|

|

Valued Poster

Join Date: Jan 3, 2010

Location: Clarksville

Posts: 59,856

|

So now you're WKing for Rick Perry by whacking on Obama. Makes perfect sense.

|

|

Quote

| 1 user liked this post |

08-24-2011, 09:05 AM

08-24-2011, 09:05 AM

|

#32

|

|

Valued Poster

Join Date: Jan 10, 2010

Location: Austin

Posts: 1,000

|

Quote:

Originally Posted by DTorrchia

... I believe Corporations should pay their fair share of taxes.

|

The rest of the world disagrees. Or rather I should say the rest of the world has a more sophisticated understanding of macroeconomics than most Americans.

The US corporate income tax rate is among the highest, if not the highest, in the world. As a percentage of income, the USA is about on par with Japan:

http://en.wikipedia.org/wiki/Tax_rates_around_the_world

As a straight percentage rate, it's the highest among developed nations at 35%. Even Canada taxes corporate profit at only about 22%:

http://www.taxfoundation.org/news/show/22917.html

I'm willing to bet there isn't a more conservative poster on these boards than me, but my take on corporate income taxes isn't about ideology at all. It's about simple, basic economics. And mock Mr. Romney all you want, but the essence of his remark about corporations is exactly right. I first heard this as a college freshman, from Milton Friedman himself: corporations don't pay taxes; PEOPLE pay taxes. You only THINK corporations pay taxes.

Taxing a corporation's profit merely allows the government, your new master, to get its grubby hands on money before it passes through to shareholders as dividends. It's a stealth tax. If your government wanted to be entirely honest, transparent and above-board about raising revenue, it would allow ALL profits of corporations to pass through as income to the shareholders and employees, where it could be taxed directly as personal income. So what if the CEO makes $20MM instead of $10MM, as long as he pays his PERSONAL income taxes on that extra $10MM?

But raising revenue isn't what our tax code is about anymore. It's about social engineering and vote-buying.

The Messiah's take on taxation is ENTIRELY ideological. Listen to what he said about taxing CAPITAL GAINS in a debate with Hillary:

http://www.youtube.com/watch?v=c4iy2OfScQE

Even when presented with abundant historical evidence that raising the cap gains tax rate leads to lower revenue and vice versa, he says he'll STILL do it as a matter of "fairness." When you set a tax rate that you KNOW will lead to lower revenue, you're not taxing to finance government operations. You're taxing to punish success, pure and simple. Be sure to listen to the WHOLE clip. Near the end he says it's immoral to take out a credit card marked "Bank of China" to pay for new spending. You'll laugh your ass off.

|

|

Quote

| 3 users liked this post |

08-24-2011, 09:17 AM

08-24-2011, 09:17 AM

|

#33

|

|

Valued Poster

Join Date: Jan 10, 2010

Location: Austin

Posts: 1,000

|

Sorry, I made a mistake. In my last post I linked to a YouTube video and said Obama remarked in that video clip that it's "immoral" to put excess government spending on a Bank of China credit card. What he actually said is that it's "irresponsible" to do so. But it doesn't matter because I don't think he knows the meaning of either of those words. No harm, no foul.

|

|

Quote

| 1 user liked this post |

08-24-2011, 10:36 AM

08-24-2011, 10:36 AM

|

#34

|

|

Valued Poster

Join Date: Jan 3, 2010

Location: Clarksville

Posts: 59,856

|

Says you... big difference between irresponsible and immoral.

Perry has run his last few campaigns based on a set of "morals," or whatever you want to call the shit he's spouted to court the religious right and teabaggers. Not once will responsibility, social or otherwise, enter into the discussion of government decisions.

But thanks for correcting that.

|

|

Quote

| 1 user liked this post |

08-24-2011, 11:24 AM

08-24-2011, 11:24 AM

|

#35

|

|

Valued Poster

Join Date: Jul 20, 2011

Location: Georgetown

Posts: 466

|

Quote:

Originally Posted by Yssup Rider

Says you... big difference between irresponsible and immoral.

Perry has run his last few campaigns based on a set of "morals," or whatever you want to call the shit he's spouted to court the religious right and teabaggers. Not once will responsibility, social or otherwise, enter into the discussion of government decisions.

But thanks for correcting that.

|

Thanks for proving my point Yssup. Rather than deal with the "issue" that Mastermind brought up, namely that Corporations are already taxed higher when compared to other industrialized countries (something I myself have not researched), you immediately bring up Perry again. Then you want to talk about someone WK'ing for Perry?

You're so blinded by your leftist ideology that you can't discuss a single issue on the merits of the topic being discussed without ranting about Perry or Bush. Try having an intelligent discourse on the merit of the point brought up. If you can dispute Mastermind's assertion, do so, but for ONCE just leave the name Perry out of it. It has no bearing on whether or not Corporations are being taxed fairly and whether or not the Government would gain more revenue by allowing Corporate profits to go the shareholders and simply taxing them straightforward.

I for one will have to do some research on this.

|

|

Quote

| 1 user liked this post |

08-24-2011, 03:24 PM

08-24-2011, 03:24 PM

|

#37

|

|

Lifetime Premium Access

Join Date: Aug 22, 2010

Location: austin

Posts: 683

|

U.S. companies face the sixth- highest effective tax rate in the world, according to a study by PricewaterhouseCoopers LLP.

http://www.bloomberg.com/news/2011-0...udy-finds.html

The tax rate for the largest U.S. companies between 2006 and 2009 was 27.7 percent, compared with a non-U.S. average of 19.5 percent,

|

|

Quote

| 1 user liked this post |

08-24-2011, 03:29 PM

08-24-2011, 03:29 PM

|

#38

|

|

Valued Poster

Join Date: Jul 20, 2011

Location: Georgetown

Posts: 466

|

Quote:

Originally Posted by budman33

|

As I stated on Page 1 of this thread, I certainly believe Corporations should pay their fair share of taxes. Mastermind's post as well as the article I posted in Forbes about Warren Buffet, both allude to the fact that higher taxes on Corporations ultimately mean less revenue, maybe less jobs etc.

This is where I'm still sitting on the fence. I've read the arguments made by both sides but still haven't seen anything conclusive of whether or not our economy would be better by making Corporations pay more taxes.

|

|

Quote

| 1 user liked this post |

08-24-2011, 04:33 PM

08-24-2011, 04:33 PM

|

#39

|

|

Valued Poster

Join Date: Jan 1, 2010

Location: Austin, TX

Posts: 641

|

Quote:

Originally Posted by DTorrchia

If either you or F-Sharp had bothered to actually read and comprehend the positions of several conservatives here, you would have picked up on that fact long ago. .

|

I can only speak for myself, but having debated the "positions of serveral conservatives here" for the past few months, I'm quite familiar their positions. It's you that's failed to read and comprehend the fact that their positions have suddenly changed and they're simply being called to task. Sound familiar D?

Quote:

Originally Posted by DTorrchia

I'm not a fan of Rick Perry becoming our next President, I don't agree with many of his positions. However when guys like you start acting like he's the next coming of the Anti-Christ, many of us feel obliged to point out the shortcomings of the current idiot that's holding our nation's highest office.

|

In psychology that's called deflecting.

|

|

Quote

| 1 user liked this post |

08-24-2011, 05:00 PM

08-24-2011, 05:00 PM

|

#40

|

|

Valued Poster

Join Date: Jan 1, 2010

Location: Austin, TX

Posts: 641

|

Quote:

Originally Posted by Billy_Saul

U.S. companies face the sixth- highest effective tax rate in the world, according to a study by PricewaterhouseCoopers LLP.

http://www.bloomberg.com/news/2011-0...udy-finds.html

The tax rate for the largest U.S. companies between 2006 and 2009 was 27.7 percent, compared with a non-U.S. average of 19.5 percent,

|

I do believe this study is misleading. You have to keep reading to get to the good part: "The study examined taxes as reported for book accounting purposes. That means it typically reflects tax obligations and benefits as companies accrue them, not as they are paid. It also doesn’t differentiate between taxes paid to governments in companies’ home countries and taxes paid to other governments."

It is without question that the "largest U.S. companies between 2006 and 2009" are all doing business outside of our borders and are certainly paying the countries they are doing business in for that prviledge. The reallity is that as far as the U.S. alone is concerned, corporations here pay one of the LOWEST tax rates in the entire world due to subsidies, loopholes, and deductions. The average is about 4-25% total, sometimes nothing...sometimes LESS than nothing meaning of course huge tax rebates. "Of the 500 big companies in the well-known Standard & Poor’s stock index, 115 paid a total corporate tax rate — both federal and otherwise — of less than 20 percent over the last five years, according to an analysis of company reports done for The New York Times by Capital IQ, a research firm. Thirty-nine of those companies paid a rate less than 10 percent."

http://www.nytimes.com/2011/02/02/bu...leonhardt.html

"The average effective U.S. corporate tax rate—the amount of tax corporations actually pay—is far lower than 35 percent, roughly 20 percent to 25 percent by some estimates. Thanks to the diligent and widespread use by many companies of hundreds of billions of dollars in tax breaks, and because the earnings of many firms are reported on individual, rather than corporate returns, the U.S. raises very little tax revenue from corporations. And the variation of tax liability among corporations is huge. GE pays a 3.6 percent rate. Disney pays 36.5 percent."

http://www.csmonitor.com/Business/Ta...ax-revenue-pie

|

|

Quote

| 1 user liked this post |

08-24-2011, 05:48 PM

08-24-2011, 05:48 PM

|

#41

|

|

Account Disabled

Join Date: Dec 23, 2009

Location: Central Texas

Posts: 15,047

|

Quote:

Originally Posted by DTorrchia

However when guys like you start acting like he's the next coming of the Anti-Christ

|

Geez, I do not recall you questioning any of the Tea Party posters when they ranted and raved for the past 3 years about Obama's ethnic, birth and religious background. One guy raises a concern about Gov Good Hair and you get your panties in a wad!

Apparently partisan politics is not your callin' !!!!!! ROTFLMAO

|

|

Quote

| 1 user liked this post |

08-24-2011, 06:04 PM

08-24-2011, 06:04 PM

|

#42

|

|

Valued Poster

Join Date: Jan 3, 2010

Location: Clarksville

Posts: 59,856

|

Quote:

Originally Posted by DTorrchia

Thanks for proving my point Yssup. Rather than deal with the "issue" that Mastermind brought up, namely that Corporations are already taxed higher when compared to other industrialized countries (something I myself have not researched), you immediately bring up Perry again. Then you want to talk about someone WK'ing for Perry?

|

IF THE FOO SHITS, WEAR IT, BRO.

I think I can speak for more than half of us here by saying that the 15 years of so years of listening to some of the guys around here whine about Clinton and now Obama as the roots of all things evil in this world - especially during the Bush administration - was among the most frustrating barriers to any decent political discourse, both here and on the previous board.

The "issue" has been brought up numerous times. And I've stated my opinion that corporate welfare has combined with two unnecessary wars to do more to sink our economy than any government entitlement for healthcare, retirement or social welfare.

To read threads about the oppression of American corporations by the big bad government taxman is a tired discussion. Links abound on the subject. The fact is, that GE is paying next to nothing, but shipping how many jobs abroad? There is nothing anywhere that comes close to a fair share. It would take a major act of Congress to make that happen -- and no doubt result in a much nastier fight than Obamneycare. In the end, they'd find a way to raise taxes but increase loopholes, right?

No, the "issue" here is that idealogues like you would rather not talk about your piss poor choices for President but whine when anybody dare blame anything on Bush.

WK for Perry? Yes sir... we hear you loud and clear.

I promise you Jesus wouldn't let these greedy corporations get away with highway robbery. But Perry will!

Payback's a bitch. And so is the Governor of Texas!

|

|

Quote

| 1 user liked this post |

08-24-2011, 06:07 PM

08-24-2011, 06:07 PM

|

#43

|

|

Valued Poster

Join Date: Jan 10, 2010

Location: Austin

Posts: 1,000

|

Quote:

Originally Posted by F-Sharp

I do believe this study is misleading. You have to keep reading to get to the good part: "The study examined taxes as reported for book accounting purposes. That means it typically reflects tax obligations and benefits as companies accrue them, not as they are paid. It also doesn’t differentiate between taxes paid to governments in companies’ home countries and taxes paid to other governments."

It is without question that the "largest U.S. companies between 2006 and 2009" are all doing business outside of our borders and are certainly paying the countries they are doing business in for that prviledge. The reallity is that as far as the U.S. alone is concerned, corporations here pay one of the LOWEST tax rates in the entire world due to subsidies, loopholes, and deductions. The average is about 4-25% total, sometimes nothing...sometimes LESS than nothing meaning of course huge tax rebates. "Of the 500 big companies in the well-known Standard & Poor’s stock index, 115 paid a total corporate tax rate — both federal and otherwise — of less than 20 percent over the last five years, according to an analysis of company reports done for The New York Times by Capital IQ, a research firm. Thirty-nine of those companies paid a rate less than 10 percent."

http://www.nytimes.com/2011/02/02/bu...leonhardt.html

"The average effective U.S. corporate tax rate—the amount of tax corporations actually pay—is far lower than 35 percent, roughly 20 percent to 25 percent by some estimates. Thanks to the diligent and widespread use by many companies of hundreds of billions of dollars in tax breaks, and because the earnings of many firms are reported on individual, rather than corporate returns, the U.S. raises very little tax revenue from corporations. And the variation of tax liability among corporations is huge. GE pays a 3.6 percent rate. Disney pays 36.5 percent."

http://www.csmonitor.com/Business/Ta...ax-revenue-pie

|

And what lesson should you draw from this summary? Perhaps that trying to impose a tax on a corporate entity creates severe, unequal, unfair distortions in the allocation of capital? From one legal jurisdiction to another, from one state to another, from one country to another, from one friend or enemy of Obama to another, what you get is unequal treatment, enormous lost productivity and uncertainty in the capital markets. You don't have to look too hard to find friends and enemies of Obama. Ask those Boeing execs how well that airplane factory is working out in South Carolina. No, that's not a taxation issue, but there's no better current illustration of the evil of allowing the government to dictate how capital is allocated, whether it's through taxation or - in the case of Boeing - by a perverse misapplication of labor law.

My original claim stands unrefuted. I said the corporate tax rate - 35% - is the highest in the industrialized world. OF COURSE special sweetheart deals and loopholes mean some corporations pay less. OF COURSE corporations (GE) that position themselves well with the powerful and well-connected get special treatment. What else would you expect when you allow liberals to turn the tax code into a tool with which to punish and reward, rather than simply a means of raising revenue to pay for the functioning of government?

The corporate income tax makes liberals feel good because they at once punish evil corporations and lessen the burden of the poor downtrodden masses. A political win-win, right?

I'll say it again, and you can ignore it again, but it's true. Corporations don't pay taxes. PEOPLE pay taxes. The folks in Washington want you to THINK corporations pay taxes. If they - the politicians - can get you to think that your individual tax burden can be lessened if you'll just allow them to collect more taxes from evil corporations, then you'll vote for them, right? But one way or another, every dollar they extract in taxes from a legal entity known as a corporation will ultimately be paid by you the consumer, or you the shareholder, or you the employee, in the form of higher prices, lower dividends, or depressed wages.

I just don't see what's so hard to understand about this.

|

|

Quote

| 1 user liked this post |

08-24-2011, 08:11 PM

08-24-2011, 08:11 PM

|

#44

|

|

Valued Poster

Join Date: Jan 1, 2010

Location: Austin, TX

Posts: 641

|

Quote:

Originally Posted by mastermind238

I just don't see what's so hard to understand about this.

|

Fascist fiction.

Fact is companies like Boeing are part of the problem. If they had their way, as evidenced by this whole South Carolina attempt to punish their union, we would all be working for $1.50 an hour with no benefits. How ironic it is you should be concerned over how government dictates how capital is allocated. Boeing made roughly $10 billion in profits over the last 3 years. How much of those profits did they pay in Federal Tax dollars? ZERO! Even more ironic that Boeing is by and large a government contracted business.

http://www.nytimes.com/2011/04/21/bu...eing.html?_r=1

Quote:

Originally Posted by mastermind238

My original claim stands unrefuted. I said the corporate tax rate - 35% - is the highest in the industrialized world.

|

Wrong. Japan has us beat @ 39.5%

http://www.guardian.co.uk/news/datab...ax-rates-world

Quote:

Originally Posted by mastermind238

OF COURSE

|

Quote:

Originally Posted by mastermind238

special sweetheart deals and loopholes mean some corporations pay less. OF COURSE corporations (GE) that position themselves well with the powerful and well-connected get special treatment. What else would you expect when you allow liberals to turn the tax code into a tool with which to punish and reward, rather than simply a means of raising revenue to pay for the functioning of government?

|

Correction, MOST corporations pay less, far less. Any company rolling in profits can afford to put former IRS agents and the best tax attorneys money can buy on the payroll. You take no issue with this? And yes, I do feel that any company willing to send desperately needed jobs to third world countries should be punished. In all honestly, I'd be more than fine if they simply paid their fair share.

Quote:

Originally Posted by mastermind238

I'll say it again, and you can ignore it again, but it's true. Corporations don't pay taxes. PEOPLE pay taxes. The folks in Washington want you to THINK corporations pay taxes. If they - the politicians - can get you to think that your individual tax burden can be lessened if you'll just allow them to collect more taxes from evil corporations, then you'll vote for them, right? But one way or another, every dollar they extract in taxes from a legal entity known as a corporation will ultimately be paid by you the consumer, or you the shareholder, or you the employee, in the form of higher prices, lower dividends, or depressed wages.

|

Horseshit. The only thing a higher tax burden does to a corporation is cut in to it's profits. That effects dividends and little else. Dividends that only a very small portion of our population can afford to participate in anyway.

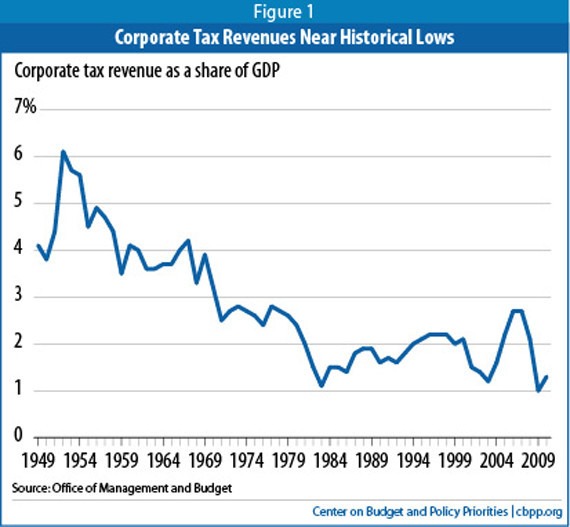

Corporate tax revenue as share of GPD is at historic lows while at the very same time corporations in many sectors are enjoying record profits.

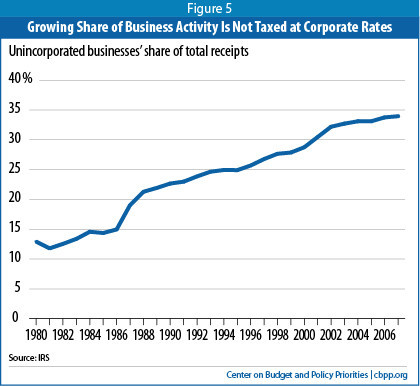

And here's another trend, taking on an unincorporated business status to further dodge paying taxes. With our country $1.4 trillion in the whole year due to tax breaks, I can't imagine how this can be considered defensible.

|

|

Quote

| 1 user liked this post |

08-24-2011, 08:56 PM

08-24-2011, 08:56 PM

|

#45

|

|

Valued Poster

Join Date: Oct 30, 2009

Location: Houston

Posts: 1,648

|

Quote:

Originally Posted by DTorrchia

As I stated on Page 1 of this thread, I certainly believe Corporations should pay their fair share of taxes. Mastermind's post as well as the article I posted in Forbes about Warren Buffet, both allude to the fact that higher taxes on Corporations ultimately mean less revenue, maybe less jobs etc.

This is where I'm still sitting on the fence. I've read the arguments made by both sides but still haven't seen anything conclusive of whether or not our economy would be better by making Corporations pay more taxes.

|

fair enough, but can you agree that you have a fair idea what happens when corporations can pay not only no taxes but get billions in refunds due to incentives? They are sitting on trillions of cash but I dont see them going out and creating jobs. it's their money so they are hoarding it and waiting to see where the chips fall in my opinion instead of helping, which is what we're told every day by the 'news' channels that they will do if we only give them even heartier tax breaks.

|

|

Quote

| 1 user liked this post |

|

AMPReviews.net

AMPReviews.net |

Find Ladies

Find Ladies |

Hot Women

Hot Women |

|